Rising volumes of retired lithium batteries create recycling pressure, high compliance risks, and cost uncertainty. Poor planning leads to overspending, inefficiency, and delays. A well-structured cost framework clarifies investment decisions.

The cost to build a lithium battery recycling plant typically ranges from USD 5 million to over USD 50 million, depending on capacity, process route, automation level, environmental compliance, and localization. Key cost drivers include technology selection, equipment, utilities, environmental systems, and long-term operating efficiency.

Understanding the real cost structure is the first step toward building a profitable, compliant, and scalable lithium battery recycling operation.

Table of Contents

1. Core Factors That Determine Investment Cost

The cost of building a lithium battery recycling plant is not a fixed number. It is a system-level investment that depends on strategic positioning, target capacity, and regulatory environment. Investors must evaluate several interrelated variables.

Processing capacity is the most visible cost driver. A small pilot-scale plant processing 5,000–10,000 tons per year may require USD 5–10 million, while an industrial-scale facility exceeding 50,000 tons annually can easily exceed USD 30–50 million. Higher capacity increases equipment size, redundancy, utilities, and automation complexity.

Recycling process route significantly impacts capital expenditure. Pyrometallurgical processes have high energy consumption and furnace investment but simpler front-end handling. Hydrometallurgical processes require more complex liquid-solid separation, extraction, and wastewater treatment systems, increasing equipment count but offering higher metal recovery rates. Direct recycling adds precision equipment and strict process control, further raising upfront costs.

2. Equipment and Process System Costs

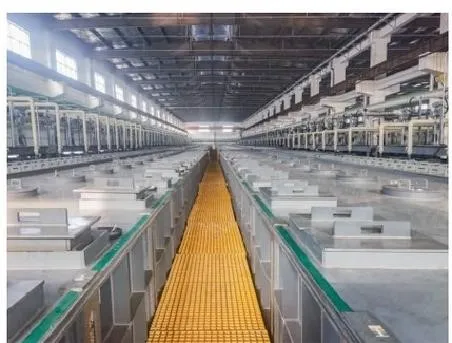

Equipment usually represents 40–60% of total capital expenditure. This includes dismantling systems, crushing and sorting lines, leaching reactors, extraction units, filtration systems, and drying equipment.

Advanced extraction and separation systems, such as tubular extractors or high-efficiency mixing systems, increase initial investment but reduce chemical consumption and operating costs over time. Corrosion-resistant materials, such as PPH, HDPE, or specialized alloys, also raise equipment prices but are essential for long-term stability in acidic and alkaline environments.

Automation level further affects cost. Fully automated feeding, monitoring, and control systems increase capital investment but significantly reduce labor costs, safety risks, and operational variability.

3. Environmental Protection and Compliance Costs

Environmental compliance is one of the most underestimated cost components in lithium battery recycling projects. Wastewater treatment, waste gas treatment, solid residue handling, and noise control systems can account for 15–25% of total investment.

Stricter regulations in Europe, North America, Japan, and South Korea require advanced treatment systems, continuous monitoring, and redundant safety designs. Plants designed without sufficient environmental margins often face retrofitting costs that far exceed initial savings.

Investing upfront in compliant environmental protection systems not only reduces regulatory risk but also improves project bankability and long-term operating licenses.

4. Infrastructure, Utilities, and Civil Engineering

Civil construction and infrastructure typically represent 10–20% of total investment. This includes plant buildings, foundations, storage tanks, pipe racks, roads, and safety zones.

Utility systems—power supply, steam, compressed air, water treatment, and cooling—must be designed to match peak process demand. In regions with unstable energy supply or high utility costs, additional backup systems may be required, increasing capital expenditure.

Site selection also influences cost. Industrial parks with existing utilities and waste treatment infrastructure significantly reduce initial investment compared to greenfield sites.

5. Engineering, Design, and EPC Costs

Professional engineering design is critical to cost control. Process simulation, material balance optimization, and equipment layout directly affect plant efficiency and scalability.

EPC (Engineering, Procurement, and Construction) services typically account for 5–10% of total project cost. While some investors attempt to reduce EPC expenses, insufficient engineering often leads to design flaws, bottlenecks, and higher operating costs.

A well-integrated EPC approach ensures that process design, equipment selection, and construction execution are aligned from the beginning.

6. Operating Cost Perspective and Long-Term Economics

While this article focuses on capital cost, investors must consider operating expenses when evaluating total project economics. Plants with higher upfront investment but better recovery rates, lower reagent consumption, and reduced downtime often achieve lower cost per ton over their lifecycle.

Energy efficiency, solvent recovery, corrosion resistance, and maintenance accessibility all influence long-term profitability. Therefore, the lowest construction cost rarely translates into the highest return on investment.

7. Typical Cost Ranges by Project Scale

As a general reference:

-

Pilot or small-scale plant (≤10,000 t/y): USD 5–10 million

-

Medium-scale plant (10,000–30,000 t/y): USD 10–25 million

-

Large industrial plant (≥50,000 t/y): USD 30–50+ million

These ranges vary by region, technology choice, and environmental standards, but they provide a realistic planning baseline.

8. How to Control Investment Risk

Cost control starts at the concept stage. Clear feedstock definition, realistic capacity planning, and future expansion considerations reduce redesign risk. Selecting experienced technology and equipment partners helps avoid hidden costs caused by corrosion, inefficiency, or non-compliance.

Modular design, phased construction, and scalable equipment layouts allow investors to align capital expenditure with market growth.

Building a lithium battery recycling plant is not just a construction project—it is a long-term industrial system investment.

A clear cost structure enables smarter decisions, lower risk, and sustainable returns.